As we usher in the New Year, many of us reflect on the past and set resolutions for the future. A resolution is just an over complicated term we use for a GOAL. The top 10 resolutions (goals) generally made at the new year are:

- Exercise

- Lose weight

- Get organized

- Learn a new skill

- Live life to the fullest

- Save money/Spend less

- Quit smoking

- Spend time with family & Friends

- Travel more

- Read more

While exercise tops the list, I would argue it is equally important to consider financial well-being. One area that plays a crucial role in our financial health is credit and just know sometimes credit repair is a necessity. In this blog post, we’ll explore the connection between credit and New Year’s resolutions, offering practical tips to help you achieve a credit-worthy year ahead.

Be in the Right Headspace:

It is the American way to want immediate gratification. This is often why we don’t follow through with those New Year’s Resolutions we make. Some advice when sitting down to write out your goals is to accept the fact gradual change is probably best. Allow yourself some room for error. After all, we are human, and it is our nature to go off course from time to time. Chart your progress and celebrate mini milestones (within reason).

Set Realistic Credit Goals:

Instead of vague goals, set clear and achievable credit goals for the year. The acronym we use is SMART:

- S: Specific

- M: Measurable

- A: Attainable

- R: Relevant

- T: Time Sensitive

Whether it’s paying down credit card debt, increasing your credit score, or establishing an emergency fund, having specific targets will give you a roadmap to follow. Make sure the goal is motivating to you. This is a personal journey of YOURS! Break down these goals into smaller, manageable tasks to track your progress throughout the year.

At The Phenix Group, our commitment extends far beyond the scope of mere credit repair; we embody the vision of being “More Than Credit Repair.” Central to our mission is a dedication to credit education, driven by the belief that informed individuals are empowered individuals. As you embark on the journey of setting and achieving your goals, consider embracing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-Sensitive. Let these principles act as a roadmap, guiding you towards well-defined objectives and ensuring a more strategic and successful outcome.

Create a Budget:

A well-structured budget is the foundation of financial stability. Take the time to analyze your income and expenses and allocate funds towards paying off debts and building savings. Having a budget not only helps you control your spending but also allows you to prioritize debt repayment, contributing positively to your credit profile.

Understand Your Credit Score:

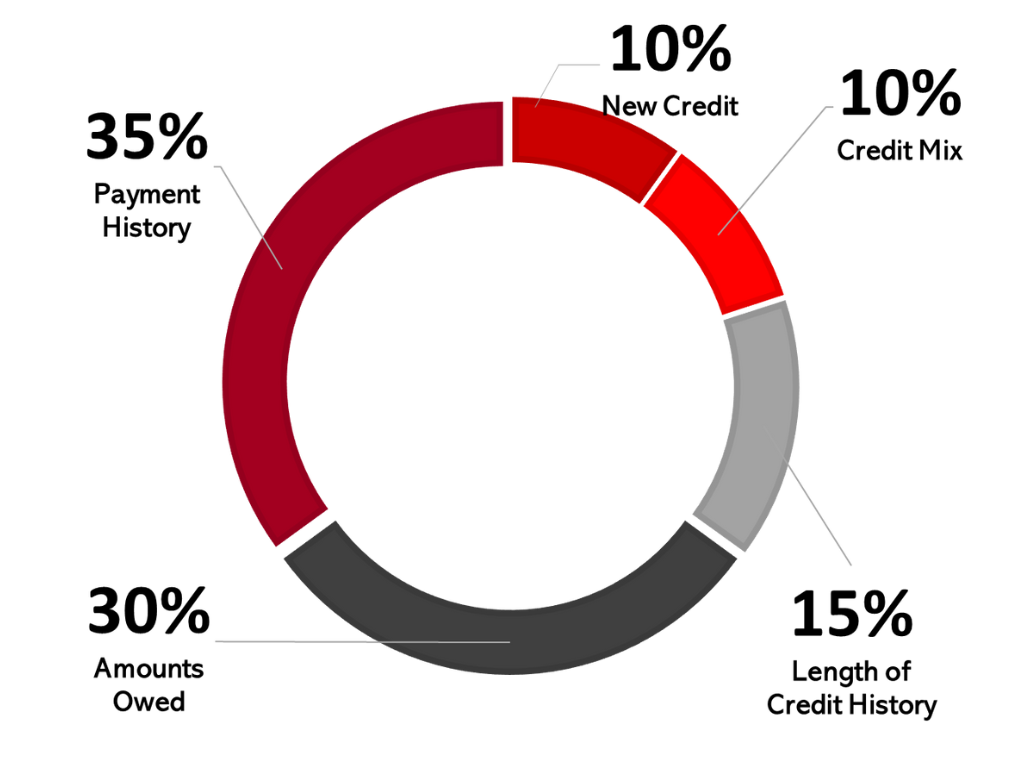

The first step towards improving and/or repairing your credit is understanding it. Obtain your credit report and review it thoroughly. Take note of any discrepancies and ensure that all the information is accurate. Your credit score is a snapshot of your creditworthiness, influencing everything from loan approvals to interest rates. Knowing where you stand is crucial for making informed financial decisions.

Prioritize Debt Repayment:

If you have outstanding debts, prioritize paying them off. Start with high-interest debts like credit cards and loans. Consider consolidating debts to streamline payments and potentially lower interest rates. Regular and timely payments are crucial for maintaining and improving your credit score.

Build Emergency Savings:

Unexpected expenses can derail even the best financial plans. Building an emergency fund is a resolution that can shield you from the financial impact of unforeseen circumstances. Aim to save at least three to six months’ worth of living expenses in a separate account to provide a financial safety net. Remember, savings aren’t to be touched for anything short of an emergency-those new shoes can wait!

Monitor Your Credit Regularly:

Make it a habit to monitor your credit report regularly throughout the year. This allows you to catch any errors or fraudulent activities early on. We recommend you utilize Experian.com as a baseline to monitor. They offer FICO based credit scores which are comparable to those creditors will be utilizing. Credit Karma is a good tool for immediate notification of new inquiries and accounts, but the Vantage scoring model doesn’t relate to anything a creditor will generally use.

Educate Yourself About Credit:

Financial literacy is key to making informed decisions about credit. Take the time to educate yourself about credit scores, interest rates, and the impact of financial choices on your creditworthiness. Understanding the factors that influence your credit can empower you to make better financial decisions.

As you embark on a new year filled with hope and resolutions, don’t forget to include your financial well-being in your plans. By setting realistic SMART credit goals, creating a budget, prioritizing debt repayment, and staying informed, you can pave the way for a financially fit and credit-worthy year ahead. If you need any help or guidance with your credit reach out to The Phenix Group for help. Here’s to a prosperous New Year!